Welcome back to Hong Kong FinTech Week!

“I have full confidence in the growing strength of our innovation and financial ecosystem”

Keynote by Dr Bernard Chan, Acting Secretary for Commerce and Economic Development, HKSAR

“Our city is indeed back with a bang,” declared Dr Bernard Chan. The Acting Secretary for Commerce and Economic Development affirmed the Hong Kong SAR Government’s determination to attract enterprises and investment to solidify the city’s status as China’s international I&T hub.

“We will continue our endeavour to attract enterprises, in particular those that are important to our development. And FinTech of course is among industries of strategic importance to us,” Chan said. He cited the 300 mainland and overseas projects that InvestHK has facilitated in establishing businesses in Hong Kong, highlighting the fact that Fintech made up a significant percentage of them.

He outlined policies promoting e-commerce, of which FinTech is a driving force. These include an interdepartmental e-commerce development task force, an e-commerce shopping festival, and “E-Commerce Easy” that provides dedicated funds for branding and upgrading ecommerce businesses with up to HK$7 million in funding.

“With the rapid development of the GBA as an engine of growth, and our unique competitive advantages of enjoying strong support of the motherland and being connected to the world under One Country Two Systems, Hong Kong certainly has a very bright future,” Chan concluded.

Click here to watch the playback

Highlights of the day

“As the world continues to grapple with turmoil, Hong Kong offers stable, orderly growth and long-term vision and resolve.”

Welcome Keynote by Professor Sun Dong, Secretary for Innovation, Technology and Industry, HKSAR

Professor Sun Dong welcomed FinTech Week attendees by celebrating Hong Kong’s innovative accomplishments and its role in “redefining FinTech into a new era of finance.”

The esteemed Secretary for Innovation, Technology and Industry praised the FinTech community for their achievements, especially in Hong Kong’s ability to attract overseas startups as a “hub for global talent.” He mentioned Hong Kong Science Park and Cyberport for their respective announcements of new infrastructure to support I&T sectors. Sun further highlighted the Hong Kong Monetary Association’s (HKMA) Commercial Data Interchange (CDI) and the continued enhancement of the Hong Kong government’s iAm Smart platform. “The above examples are just part of [the government’s] efforts in driving FinTech development in Hong Kong.” Sun remarked.

He concluded his keynote by pinpointing Chief Executive John Lee’s announcement of the $500 million Digital Transformation Support Pilot Programme in the 2023 Policy Address. “I am confident that these initiatives will definitely give our FinTech cluster a strong impetus and lead Hong Kong to be one of the FinTech leaders in the world," he added.

Please refer to the official speech here.

Click here to watch the playback.

“The insurance industry can do more.”

Keynote by Clement Cheung, Chief Executive Office, Insurance Authority

Clement Cheung highlighted how the industry currently faces both production gaps and emerging business opportunities. The Insurance Authority chief noted two prominent production gaps: cyber-resilience and climate change.

He shared that the global cyber insurance market is projecting a “very impressive growth” path and that “this market cannot be missed,” outlining the steps the industry has taken to address these production gaps. He then moved on to climate change, stating that “climate change is a global menace.” Although the Asia-Pacific region is “doing well in [GDP] growth,” we are “appalling in terms of protecting ourselves,” he remarked on the lack of coverage on climaterelated losses.

He also discussed insurance-linked securities (ILS) technology, observing that Hong Kong has “everything to make us an ILS hub,” but believed the industry can do more to boost talent, data, and models. To address the issue, he announced that the Insurance Authority is in talks with a Page 5 Hong Kong university to set up a GBA climate data portal.

Cheung opined that the insurance industry needs to be “cautiously courageous” and “know why we change,” noting that, “ultimately what we need to do is to deliver care for the society.”

Click here to watch the playback.

“The booming FinTech ecosystem is enticing companies to run operations in Hong Kong and also launch regional expansion.”

Keynote by Philip Yung, Director-General, Office for Attracting Strategic Enterprises, Financial Secretary's Office, HKSAR Government

The Director-General, Office for Attracting Strategic Enterprises (OASES), Philip Yung, emphasised the critical role of strategic enterprises to seed innovation in key industry sectors and drive ecosystem growth. He noted that Hong Kong has a great attachment to FinTech as one of four key strategic sectors that OASES is targeting to attract growing businesses to Hong Kong with the goal to fuel the city’s innovation ecosystem and a new era of economic growth.

“FinTech is one of our four strategic industries, alongside AI, health, advanced manufacturing and the new energy sector.” He added that OASES has very recently approached over 200 enterprises, with 13 already expressing interest in, or have plans to expand into Hong Kong. A number of these are from FinTech, ranging from payments and retail technology, wealth management, blockchain and virtual asset trading platforms among others. As a result Hong Kong is seeing interfaces between these sub sectors with AI companies tapping into the area of stablecoins, cross border remittances exploring the use of blockchain to streamline operations and stablecoin issuers crossing into virtual asset trading platforms.

“Technology advancements have really enabled financial services companies to improve efficiency and drive new services. The booming FinTech ecosystem is enticing companies to run operations in Hong Kong and also launch regional expansion,” added Yung.

Click here to watch the playback.

“The number of applications improved exponentially when the speed of the Internet increased. That's what we need to do with crypto.”

Fireside chat with Brian Armstrong, Chief Executive Office & Co-Founder, Coinbase

Moderated by: Minh Do. Co-Chief Operating Officer, Animoca Brands

Day two of FinTech Week featured Chief Executive Officer and Co-founder of Coinbase Brian Armstrong, who shared his views on Web3. Quizzed by Animoca Brands’ Chief Operating Officer Minh Do, Armstrong was enthusiastic about the trend towards Layer 2 blockchain solutions.

According to Armstrong, almost everything in the crypto space is running on Layer 1. “While that's been great to get hundreds of millions of people into the ecosystem, it’s still a little slow and expensive. For instance, the average transaction on Bitcoin or Ethereum might take anything from US$1 to US$20 and anywhere from a minute to an hour to confirm,” he said.

Layer 2 brings down the fees and confirmation times, making everything faster and cheaper. Armstrong likened the development to when the Internet moved from dial up broadband. “The number of applications improved exponentially when the speed of the Internet increased. That's what we need to do with crypto,” he said.

Armstrong believes the average user doesn't really need to know whether they are using Layer 1 or Layer 2, in much the same way as most people using the Internet don't need to know what IP addresses their internet service providers are using. “For them, it just works,” he said.

Web3 “feels almost like it’s made for Hong Kong”

Fireside chat with Yat Siu, Co-Founder and Executive Chairman, Animoca Brands

Moderated by Karena Belin, Co-Founder and CEO, WHub AngelHub ClubDeal

Yat Siu of Hong Kong Web3 unicorn, Animoca Brands, discussed the future of Web3 with WHub’s Karena Belin. He emphasised that “the culture of blockchain is actually very compatible for Hong Kong” because of its protection of property rights, capitalist infrastructure and financial literacy.

Moving onto the topic of AI, Belin argued that AI will be a huge enabler of Web3, rather than steal the show. Siu added that “only the AI agent is going to be able to keep up with the pace of change that is coming, because at the end of the day as a human, we will have limitations as to what’s right and what’s wrong. AI will actually help with that, we will be using many AI agents to facilitate our lives. In a nutshell, it’s like having personal assistants, and you don’t have one, but dozens and dozens, and they all work for you.” He also emphasised sovereign ownership of AI as crucial to protecting from external manipulation and ensuring accountability.

Siu concluded, “Hong Kong leading the way is not just about Hong Kong, it’s about the rest of the world looking at Hong Kong” and emphasised he is looking forward to the city “cleaning the slate, moving forward, and cheering on.”

Industry insights

Digital Assets/Web3

“Gaming is a slam dunk for Web3”

Fireside chat with Daniel Alegre, CEO, Yuga Labs

In this fireside chat, Yuga Labs CEO and former COO at Activision/Blizzard, Daniel Alegre, shared his views on a world which is becoming increasingly social and digitally connected. He believes this is driving the adoption of digital identities, the rush to the metaverse, and Web3.

“Web3 is the natural evolution of social platforms. You have scarcity, you have utility and an incredibly strong community. It can only go up from there in terms of engagement and adoption,” he said.

The development of Web3 is tracking in a similar way to the early days of the Internet. “The Internet was complicated to start. You needed a modem, a service provider, and things failed. Today it’s hard to set up a wallet or transfer digital assets. Yet Web3 has transformed the art world, and is doing the same in gaming by creating new engagement and hard-core communities.

“Gaming is the next frontier for Web3. Gamers want to be social but in the past engagement was limited to the game. Web3 solves the pain point by allowing your digital identity and assets to transfer across to new environments and new communities. Gaming is a slam dunk for Web3.”

Bridging Digital Assets and Web3 to Power the Broader Real Economy

Panel discussion with:

Joseph Chan, Under Secretary for Financial Services and the Treasury, HKSAR

Xiao Feng, Chairman, Wanxiang Blockchain & HashKey Group

Moderated by: Tracy Zhang, Chief Marketing Officer, Following

The expert panel, moderated by Tracy Zhang, CMO of Following, discussed practical applications of digital assets and Web3 technology in Hong Kong.

Joseph Chan, the Undersecretary for Financial Services and the Treasury, noted that Hong Kong has already implemented blockchain and Distributed Ledger Technology (DLT) in the real economy. He added that Hong Kong’s cryptocurrency, security token offerings (STOs), and NFTs can be applied in many scenarios, and that the government is “leading by example by providing applications [of such technologies] for the market to consider.”

He observed that, due to the city’s concise regulatory practices, European FinTech and Web3 companies are eager to “use Hong Kong to enter Asia and mainland China markets.” He pledged that the SFC will continue to take market trends into consideration as it continues improving Hong Kong’s regulatory frameworks.

As a key player in Hong Kong’s Web3 scene, Xiao Feng, Chairman of Wanxiang Blockchain & HashKey Group, noted that Hong Kong’s Basic Law allows for innovative Web3, green tech and blockchain projects to thrive under a tolerant environment.” He is confident that such technology can be increasingly applied to the market.

Click here to watch the playback.

“CCIP has the ability to connect Web3 players to the Web2 world.”

Sergey Nazarov, CEO, Chainlink

King Leung, Head of Financial Services and FinTech, Invest Hong Kong

Speaking to King Leung in an online call, Sergey Nazarov, CEO of Chain Link, observed how as stakeholders within financial and technology sectors began creating their own chains, they came to a realisation. “If everyone makes their own chain, and we have our own chain, then how do we transact?”

He explained that some of the key features of the Cross-Chain Interoperability Protocol (CCIP) can solve such issues, which are impeding the integration of blockchain technology in financial markets, and also increase market liquidity.

Turning the conversation to a local perspective, Leung noted that, “one of the building blocks of [Hong Kong’s International Centre status] is the free flow of capital that makes Hong Kong such an attractive place for investors. It’s not hard to envision that in the future, where the underlying structure is about blockchain, then we cannot afford to have digital islands that are impeding liquidity.”

Talking about Hong Kong’s FinTech regulations, Nazarov is “very impressed by the forwardlooking nature of the policies and encouragement from various central banks and regulators” and “the clarity that’s being created by those frameworks.”

“There is a sentiment that Hong Kong needs to remain a key financial centre as it is today, and blockchains are an important part of that future,” Nazarov said.

“Hong Kong is becoming a global-leading hub for regulated virtual assets businesses.”

Fireside chat with Lennix Lai, Global Chief Commercial Officer, OKX

Moderated by Clara Chiu, CEO Qreg Advisory, and ex-SFC Head and Licensing Director

Hong Kong has developed a reputation as one of the world’s most successful locations for regulated virtual asset businesses. Ex-SFC FinTech Head and Licensing Director Clara Chiu sat down with Lennix Lai at OKX to discuss precisely why, and explore what regulatory measures are needed to maintain the city’s lead.

“Hong Kong is particularly interesting (to FinTechs) because it is a combination of technology and finance,” said Lai, noting that this makes a variety of talent types, such as programmers and back-end engineers, financially literate. “Hong Kong is particularly favourable for building your staff, especially in the FinTech and virtual asset area. That's very special, and why we put our product tech centre in Hong Kong,” he explained.

Chiu cited Hong Kong’s early start in building a regulatory framework for virtual assets as a key factor. “We started to think about whether we should regulate virtual assets in 2018 and published very detailed guidelines on what we were going to do in the next one or two years with the licensing and supervisory regime,” she said, recalling that this pioneering approach attracted international newspaper coverage.

“We set the scene. At that time a lot of international regulators were thinking about what to do, how to do it, and whether they should do it. But we were the first, and other jurisdictions have copied or taken reference from our regulations to shape their own,” she said.

In Hong Kong: “You need to have an office here.”

Fireside Chat with the Pioneers: Pascal Gauthier & Steve Rosenblum

Pascal Gauthier, Chairman & CEO, Ledger

Steve Rosenblum, CEO, Libertify

Amanda Cassette, Founder, Serotonin

Entrepreneurs of global Web3 companies gathered to discuss the decentralised FinTech market and visions for their pioneering ventures.

Steve Rosenblum of Libertify emphasised how his company caters to new demand. “They want to be their own bank. They don’t want to ask you to be their bank,” he expressed. Meanwhile, Pascal Gauthier of Ledger acknowledged Apple, “the best company in the world”, which served as the model for his integration of hardware and software.

“What we see here is a fast-growing crypto market, the Asia market. It’s something which is, for me, in terms of number of wallets, it’s really the place to be,” Rosenblum stated on Hong Kong. “It goes very quickly, there’s creativity, the people think fast, they want to mobilise.” Gauthier finally added that “Hong Kong has a fantastical geographical situation” and is a “very powerful regional hub.”

FinTech Innovation & CBDC

A Retail CBDC in Hong Kong: Lessons Learned from the e-HKD Pilot Programme

George Chou, Chief FinTech Officer, Hong Kong Monetary Authority

Gilbert Lee, Head of Strategy & Planning and Chief of Staff to Chief Executive, Hang Seng Bank

Flora Leung, Executive General Manager and Head of Retail Banking and Wealth Management, ICBC (Asia)

Monita Leung, Chief Executive Officer, Digital Ventures, HKT

Ashok Venkateswaran, APAC Head - Blockchain & Digital Assets, Mastercard

Nischint Sanghavi, Head of Digital Currencies - Asia Pacific, Visa

The Hong Kong Monetary Authority’s new report outlining the key findings of its recent e-HKD pilot programme makes interesting reading. This panel, led by the HKMA’s Chief FinTech Officer, invited experts from different organisations to put their experiences into perspective and offer a practical take on the value of a digital currency in real-world retail use cases.

Hang Seng Bank’s Gilbert Lee was particularly impressed by the programmability e-HKD offers. The bank created a private blockchain for token issuance and a hypothetical e-HKD wallet for two use cases – government disbursements and a merchant reward programme. This enabled merchants to tailor how monetary incentives could be used, such as to buy only coffee and not alcohol, or at a particular time and outlet. Likewise the government could use e-HKD to send subsidies to a certain industry, or programme what can be purchased. In addition to mitigating the risk of misuse, e-HKD also enables the government to easily trace how and where subsidies are used and measure their effectiveness.

According to Lee, 80% of the individuals in the bank’s trial were satisfied with experience, and agreed that programmability is a unique and distinguishing feature of the new e-HKD.

“All of the merchants found e-HKD beneficial to their business. Hang Seng Bank believes that programmability will drive innovation and expedite the development of the digital economy,” he said.

Click here to watch the playback.

The Cross-Boundary Application of e-CNY in Hong Kong and the Way Forward

Tim Ying, CEO, Octopus Holdings Limited

Di Gang,Deputy Director - General, Digital Currency Institute of the People’s Bank of China (Hong Kong)

Xing Guiwei, Deputy Chief Executive, Bank of China (Hong Kong)

Julian Ip, Political Assistant to Secretary for Financial Services and the Treasury, HKSAR

The panel discussion commenced by shedding light on various aspects of e-CNY in the retail perspective and its potential impact on Hong Kong. Di Gang introduced key application scenarios of e-CNY in the mainland and emphasised the value it will bring to Hong Kong in the future. He underscored that the implementation of e-CNY aims to enhance security, liquidity, and reduce costs while supporting digital transformation and smart payment solutions.

Tim Yang emphasised the collaboration between e-CNY and Hong Kong’s Octopus Card, addressing pain points for tourists by enabling seamless currency exchange and payment. Expanding on this, Xing Guiwei elaborated on their role as a pioneer in the e-CNY pilot project and their efforts to enhance cross-border RMB capacity building and promote various usage scenarios. They highlighted the importance of building basic capabilities, providing cross-border fund clearing services, and conducting characteristic scenario research to further promote the applications of e-CNY.

The discussion then shifted to the future development of e-CNY, which currently focuses on the retail end. The panelists further explored potential plans beyond retail and emphasised the bilateral cooperation between mainland China and Hong Kong to expand the acceptance environment for individual applications.

The impact of e-CNY on eHKD was also discussed, highlighting the benefits of introducing a Central Bank Digital Currency (CBDC) and the potential for e-CNY to serve as a bridge connecting Hong Kong with the rest of the world. The panel concluded by emphasising the significance of CBDCs and their potential value in driving Hong Kong's economy forward. The implementation of e-CNY provides Hong Kong with a competitive edge and solidifies its position in the global market.

Click here to watch the playback.

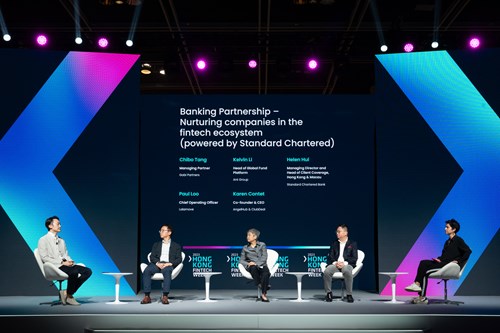

“If done well, banks and FinTech actually complement each other”

Chibo Tang, Managing Partner, Gobi Partners GBA

Helen Hui, Managing Director and Head of Client Coverage, Hong Kong & Taiwan, Standard Chartered Bank

Karen Contet, Co-Founder & CEO, AngelHub, WHub, ClubDeal

Kelvin Li, Head of Global Fund Platform, Ant Group

Paul Loo, Chief Operating Officer, Lalamove

The panel on Banking Partnership – Nurturing companies in the FinTech ecosystem (powered by Standard Chartered), began with Helen Hui repudiating the “old myth that banks and FinTech are competing in the same space.”

Moderated by Karen Contet of AngelHub, the panel comprised FinTech companies who have partnered with Standard Chartered. They reflected on the success of their collaborations and pondered future directions.

Kelvin Li of Ant Group stressed his desire to “co-build solutions” with banks, using their collaboration on a blockchain-based remittance solution in 2017-18 as an example. Paul Loo of Lalamove shared an exciting preview of a partnership set to be announced early next week, where their core business infrastructure of matching business partners to enterprises will be transformed through a partnership with Standard Chartered. It will feature a “federated learning tool that makes use of encrypted behaviour data.”

Chibo Tang at Gobi Partners reflected on the FinTech landscape where “There have been shifts and strategic changes, but I think here in Asia, a lot of it has actually been for the good.” He looked forward to building new partnerships across the region, particularly with emerging ventures in Southeast Asia, and expansions into the GBA.

“Blockchain is the most important component of Web3, but it’s not everything.”

Fireside Chat with the Pioneers

Cai Wensheng, Chairman, Longling Capital

Cynthia Wu, COO, Matrix Port

The founder of Meitu and a prominent angel investor in China is the right expert to ask for predictions on Web3, Fintech, and digital assets. Cai Wensheng, Chairman of Longling Capital sat down with Cynthia Wu, COO of Matrix Port, for an exploration on the future of these groundbreaking technologies.

He noted that there are challenges that those in the digital assets space must address, but “if we can overcome them, then we will see drastic development,” adding that “it will be like spring is coming.”

Regarding the future of tokenisation, he stated that there has been success in developing stablecoins, particularly in its regulatory legislation by the Hong Kong Government. He made a bold prediction where the public will be able to use stablecoins for their everyday expenses but stated the need for further development of a framework. He then predicted that competing stablecoin issuers will go through a process of natural elimination in the market, with two to three issuance bodies emerging victorious.

“Blockchain is the most important component of Web3, but it’s not everything,” he remarked, referring to recent attempts for Web3 infrastructure development in Hong Kong. He observed that FinTech has hit rapid milestones in recent years, but concluded that other cutting-edge technologies, including Internet infrastructures and AI, are also vital in creating a robust Web3 landscape.

“We are the last generation that will have that first introduction to financial assets in the physical form”

Cecelia Skingsley, Head of BIS Innovation Hub, Bank for International Settlements

“I think this is a very exciting and promising future,” said Cecelia Skingsley, Head of the BIS Innovation Hub. However, she also reminded everyone at FinTech Week Hong Kong that, as we go from the tangible to the intangible, the level of abstraction in the relationship between humans and our financial assets and liabilities gets bigger and bigger.

“So, for us who work in the industry, it becomes even more important that we are ensuring that what we do maintains public trust in the financial system. This is key to everything we do,” she said.

She championed the idea of working with private sector partners to build a FinTech ecosystem, and noted that BIS research and innovation projects are aimed at setting out the “the art of the possible” for banks, legislators and society as a whole.

“At BIS, we believe that under the right conditions, the next big paradigm shift could be in tokenisation,” Skingsley said. She also highlighted the BIS Innovation Centre Hong Kong Centre’s Projects Genesis, Dynamo and Embridge as cutting-edge developments that push tokenisation beyond the digital representation of money to create an integrated system.

Click here to watch the playback.

Open Finance: Unlocking Open Finance Opportunities for Different Industries

Dr Crystal Fok, Head of STP Platform, HKSTP

Ryan Fung, Chief of Retail and Digital Strategy, Shanghai Commercial Bank

Nailesh Shah, Head of Digital Channels and Customer Experience, Citibank Hong Kong

Arthur Siu, Head of Product and Proposition, Zurich Insurance (Hong Kong)

On the final day of the conference, Eric Or, Head of Partnership and Dr Crystal Fok, Head of STP Platform at HKSTP, moderated two panel sessions with business leaders on Open API and Open Finance.

In the first panel, Dr Fok emphasised the importance of creating an Open API ecosystem to drive business transformation through data and technology.

In his panel, Eric Or noted that “Open data is never limited only for the banking and finance services. We look forward to seeing wider data collaboration across different industries to support the city’s vision of a digital economy.”

He also discussed the opportunities and challenges of adopting open data from the banking, insurance and healthcare industry perspectives, and mentioned that healthcare data is the most popular data in all industries. The panel also dived deeper into industry considerations around the impact of open data while protecting privacy and security.

Early this year, HKSTP established the first city-wide community to connect data across institutional and industry boundaries for richer insights and growth opportunities. HKSTP is working closely with the Hong Kong Monetary Authority (HKMA) and the Insurance Authority (IA) to encourage banking and insurance stakeholders to collaborate on digital innovation through the use of APIs.

ESG

“FinTech is going to be a positive enabler”

Future of sustainable finance and how technologies will shape its development

Dr. Qu Kang, Managing Director, Sustainability Strategy, Bank of China (Hong Kong)

Christine Loh, Chief Development Strategist, Institute for the Environment, HKUST

John Murton, Senior Sustainability Advisor, Standard Chartered Bank

Jonathan Drew, Head of Global Banking Sustainability, Asia Pacific, HSBC

Yulanda Chung, Head of Sustainability, Institutional Banking Group Singapore, DBS

As institutions set their sights on achieving Net Zero, the panellists exchanged views on how to embed sustainability considerations into financial products, services and internal operations. Qu Kang from Bank of China and Jonathan Drew of HSBC agreed that data collection and accessibility are part of the crucial role FinTech has to play in this endeavour.

“We believe this next wave of the industrial revolution is going to be a trillion dollar business opportunity for all financial institutions involved. And in greening our portfolio and helping our Page 20 clients transition, we know that actually it may make our portfolio riskier,” Yolanda Chung stated. She also raised concerns about greenwashing and highlighted the need for science and academia in the transition to a low-carbon economy.

John Murton of Standard Chartered suggested collaborating with experts across various industries to map out correct pathways for clients, as well as “building teams over the horizon” that look into the future to problem-solve. Highlighting the economic advantages of going green was also cited as crucial to accelerating the speed of change.

HKUST’s Christine Loh emphasised that “the culture of a traditional bank itself has to change”, while Drew reflected on the wider system, saying “an individual bank needs to go beyond just what it’s doing itself, and actually use its influence in the wider space in which we operate and collaborate with other banks.”

Banking the Unbanked: How Technology can Drive Financial Inclusion

Panel discussion with:

Charles Li, Founder & Chairman, Micro Connect

Ilham Akbar Habibie, Commissioner, PT. Llthabi Rekatama

Jessica Lam, Group Chief Strategy Officer, WeLab

Marie Claire Lim Moore, Asia-Pacific Regional President and Hong Kong CEO, TransUnion

Moderated by: Alfred Shang, Managing Partner, BitRock Capital

The panel speakers offered their views on the diverse banking challenges of underserved communities, and how FinTech innovation and alternative data is widening access to critical banking services.

According to Charles Li: “Traditional big banks are not suited to really helping out the little guys. This is a great big missed opportunity and I believe a big mistake is FinTech companies trying to do or reinvent what traditional banks already do today.” He urged new players to build new platforms and services that truly deliver on the needs of small business and communities.

Jessica Lam at WeLab reiterated the importance of identifying and understanding true customer needs. “Financial inclusion in one market may be very different to another market. In Hong Kong as a mature market, the focus could be more on responsible credit services or more accessible financial management services.” Marie Claire Lim Moore from TransUnion added that alternative data is at the heart of serving underserved communities as this allows financial services providers to overcome the ‘thin file’ challenge of insufficient data for traditional credit checks. “First priority is to truly know your customer.”

For Iham Akbar Habibe at PT Llthabi Rekatama, the need for education is a first step to establishing clear needs and picking the correct solution to ensure financial inclusion.

FinTech for Climate and Nature

Panel Discussion with:

Yvonne Tsui, Senior FinTech Director, FinTech Facilitation Office, Hong Kong Monetary Authority (HKMA)

Max Song, Founder & CEO, Carbonbase Entela Benz, CEO, Intensel

Dave Sandor, Co-founder & CEO,Allinfra

Moderated by: Teresa Lin, Advisor, BIS Innovation Hub, Bank for International Settlements Innovation Hub

Experts discussed how FinTech innovations such as blockchain, tokenisation and AI are taking decarbonisation efforts to new levels. “Without AI, machine learning and real-time satellite imagery we cannot identify real-time flood risks, possible landslides or other weather-driven incidents, such as the recent Black rainstorm warning here in Hong Kong,” said Entela Benz at Intensel.

Dave Sandor at Allinfra believes there is too much attention on trends like tokenisation of climate finance products. “Underlying data for financial products in general is poor. But blockchain can really help the integrity of green bonds and carbon credits. Focus needs to be on the end financial product NOT the tokenisation,” said Sandor. Max Song at Carbonbase noted that the growth of decarbonisation initiatives in Asia requires an Asia-based registry to provide formal recognition, as three of the world’s four official registries are based in the US, and the other is located in Switzerland.

As emerging technologies are increasingly tapped to enable new products and platforms, Yvonne Tsui at the HKMA stressed the need to do proof of concepts and demonstrate technology use cases to determine clear problem statements, define goals and establish success metrics.

Click here to watch the playback.

Other Announcements

Global Fast Track - Global Scale Up Competition 2023

The annual flagship Global Fast Track brings together global innovative FinTech companies that already have commercial customers in their home market and beyond, to showcase their business solutions and connect with regional corporates and investors.

The programme culminated with the Global Scale Up competition that drew over 500 competitors from over 63 markets around the world, to pitch their ideas across the FinTech, AI and Web3 categories. The final day of Hong Kong FinTech Week 2023 saw the judges announce the grand winner as:

Libertify

CEO: Steve Rosenblum

The French-based personalised AI risk management solution provider beat 13 global finalists bidding to be crowned the grand champion.

Tokenisation to Bridge the US$2.5 trillion Global Trade Finance Gap

On the last day of the conference ZAN by Ant Group Digital Technologies signed a partnership with the Global Shipping Business Network, a not-for-profit industry global industry consortium in Hong Kong. The partnership will focus on harnessing Web3 technologies to tokenise the electronic Bill of Lading, or eBL. The Bill of Lading is a legally binding document in maritime shipping which details a physical shipment and serves as a means of transferring the title of goods. It has traditionally existed only in paper format.

One of the key use cases for Web3 is the tokenisation of real-world assets that can unlock tangible economic value and new financing opportunities. In this case, a tokenised eBL can pave the way to the securitisation of the world’s US$25 trillion trade flows and bridge the estimated US$2.5 trillion global trade finance gap according to the Asian Development Bank.

Disclaimer

The views and opinions expressed in Hong Kong FinTech Week are those of the speakers, commentators, experts and/or hosts/sponsors. They do not explicitly or necessarily reflect, nor represent the views held by Hong Kong FinTech Week, WHub, or the Government of Hong Kong Special Administrative Region. This conference has been produced to give participants a general information and a general understanding of the Fintech industry and is not to provide specific legal or investment advice.

Hong Kong FinTech Week, WHub, or the Government of Hong Kong Special Administrative Region cannot be held accountable for any views expressed during Hong Kong FinTech Week.

The information contained in this publication is for general reference only. While every effort has been made to keep information current and accurate, Hong Kong FinTech Week, WHub, or the Government of Hong Kong Special Administrative Region, does not accept any responsibility whatsoever in respect of such information. There is no implied endorsement of any materials or recommendation of a company or service provider over another.

About Hong Kong FinTech Week

Hong Kong FinTech Week 2023, organised by the FSTB and InvestHK, and co-organised by the HKMA, the SFC and the IA, is Asia's global financial technology event for scaling new heights. It is expected to host over 300 speakers, 540 sponsors and exhibitors, welcoming over 30,000 attendees and attracting over 5 million views from over 90 economies to the event. The week-long event will feature multitrack conferences with prominent speakers, exhibitions, a deal floor, workshops, networking and satellite events, demo sessions and metaverse experiences.

About InvestHK

InvestHK is the department of the Hong Kong Special Administrative Region Government responsible for attracting foreign direct investment. It has set up a dedicated Fintech team in Hong Kong to attract the world's top innovative Fintech enterprises, start-up entrepreneurs, investors, and other stakeholders to set up and scale their business via Hong Kong into Mainland China, Asia, and beyond. For more information, please visit www.hongkong-fintech.hk.

Media enquiry

Adrianna Lau

+852 3756 8615

Adrianna.Lau@edelman.com

Bonita Wong

+852 2837 4758

Bonita.Wong@edelman.com

- Tags