Safer, freer, more open, predictable biz environment in HK

By Zhang Weilan, Yang Shasha and Zhang Xueting in Hong Kong

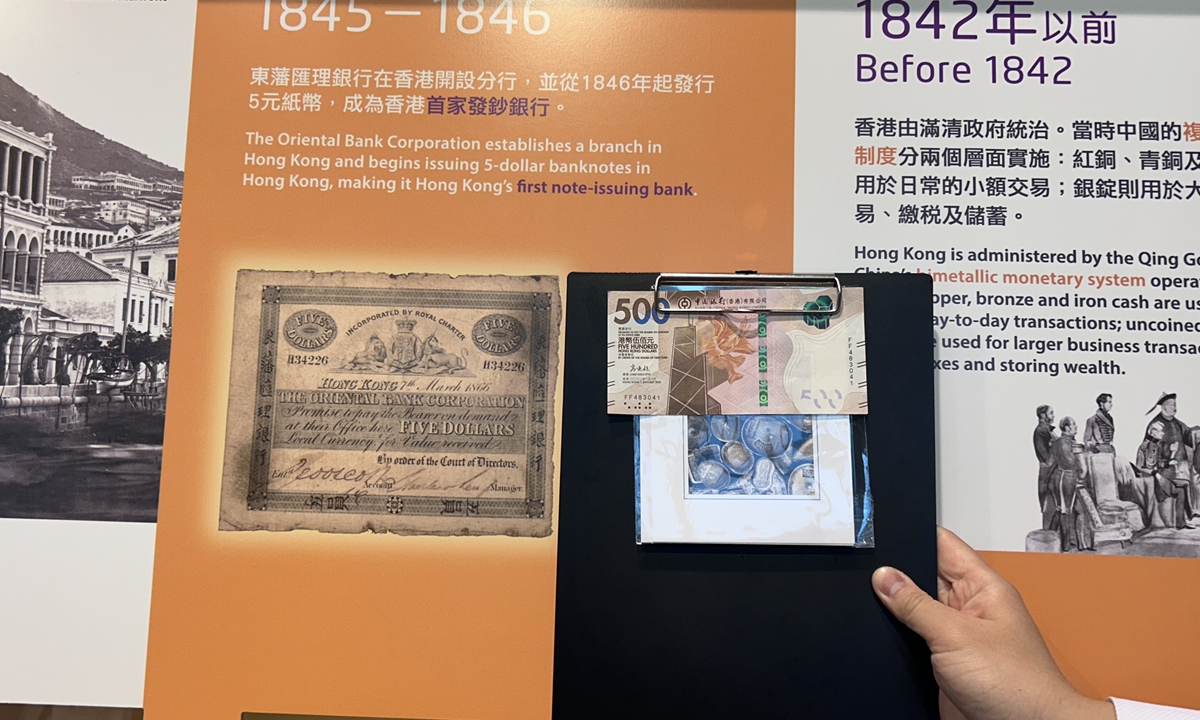

Hong Kong's currency is on display at the exhibition area of HKMA on July 16, 2024. Photo: Zhang Weilan/GT

Editor's Note:

This year marks the fifth anniversary of the unveiling of the Guangdong-Hong Kong-Macao Greater Bay Area Development Plan. The Chinese government unveiled its blueprint to turn the Greater Bay Area (GBA) into a role model of high-quality development, an international first-class bay area and a world-class city cluster.

The GBA is well on its way to shaping the future of high-quality development and driving sustainable economic growth. As one of the most economically open and vibrant areas in China, the region is at the forefront of China's reform and opening-up and technological innovation. It has developed from the world's factory into a world-class financial and innovation hub. The Global Times looks at the region's progress in meeting targets set for it, how different cities are vying to attract foreign enterprises, investing in research and development, achieving sustainable development and more.

As Hong Kong celebrates the 27th anniversary of its return to the motherland, senior financial officials in the city have emphasized the importance of leveraging the institutional advantages of the One Country, Two Systems policy to enhance Hong Kong's role as a leading international financial center in China's comprehensive opening-up efforts.

During recent interviews with the Global Times, officials from the Hong Kong Special Administrative Region (HKSAR) highlighted Hong Kong's sustained development as an international financial hub and debunked false narratives of capital outflows and a decline in foreign investment, promulgated by some Western politicians and media outlets.

Facing a turbulent external market environment and global uncertainty, Hong Kong's financial industry has displayed its unique advantages. Government officials, industry observers and entrepreneurs from both Hong Kong and the Chinese mainland said that Hong Kong's role as a global financial hub is set to remain strong in the long term.

The city's strategic location, strong infrastructure and well-developed financial system make it an attractive destination for businesses and investors from home and abroad.

A view of Hong Kong Photo: VCG

Leading international financial hub

In recent years, Hong Kong's role as a global financial hub and an asset "safe haven" has been in the limelight amid a global economic downturn, Hong Kong financial officials said.

Hong Kong has consistently been at the forefront of innovation and experimentation in the opening-up of the country's financial and capital markets, Deputy Chief Executive of the Hong Kong Monetary Authority (HKMA) Darryl Chan told the Global Times.

Chan said the just-concluded third plenary session of the 20th Central Committee of the Communist Party of China emphasized the importance of strengthening Hong Kong's position as a global hub for finance, transportation and trade. This fully demonstrated that the central government attaches great importance to the development of the financial industry in Hong Kong, which has boosted the city's confidence.

Referring to a resolution adopted at the reform-themed meeting on July 18, Darryl Chan said Hong Kong's monetary authorities are fully determined and confident that the city will remain a major international financial center, which will benefit the long-term development of its financial sector and promote China's high-level opening-up.

China will harness the institutional strengths of the One Country, Two Systems policy and work to consolidate and enhance Hong Kong's status as an international financial, shipping and trade center, support Hong Kong and Macao in building themselves into international hubs for high-caliber talent, and improve relevant mechanisms to see the two regions play a greater role in China's opening-up to the outside world, according to the resolution.

"Hong Kong has the unique advantage of the One Country, Two Systems policy in maintaining its financial stability and promoting financial development," Chan said, noting that China's commitment to promoting the high-quality development of the financial sector and building China's financial strength has brought huge development opportunities to Hong Kong.

With its strengths in banking, capital markets and asset management, Hong Kong provides an all-encompassing and high-quality financial platform for investors, financiers, asset managers, funds and financial institutions from all over the world, the HKMA said.

To solidify Hong Kong's status as a global financial hub and drive innovation, the HKMA will prioritize maintaining financial system stability, developing a robust financial ecosystem and capitalizing on long-term growth opportunities, according to Darryl Chan.

Backed by mainland

Invest Hong Kong, an official department responsible for attracting foreign direct investment in Hong Kong in July announced that it assisted 322 Chinese mainland and overseas companies to set up or expand their operations in Hong Kong during the first six months of 2024, up 43 percent year-on-year.

Total investment into the local economy reached HK$38.3 billion ($4.9 billion), up 6 percent year-on-year, with more than 3,500 jobs created, up 44 percent year-on-year, according to Invest Hong Kong.

The growth was attributable to the gradual recovery of the global economy and the continuous support of the country, which accelerated the pace of companies expanding their business to Hong Kong, Alpha Lau, Invest Hong Kong's director-general of investment promotion said.

The opening of many accounts and accompanying capital inflows show that global investors are "voting with their feet" on Hong Kong's position as an asset "safe haven," King Leung, head of fintech at Invest Hong Kong, said.

After building up a defense for safeguarding national security, Hong Kong has showcased to the world a business environment that is safer, freer, more open and more predictable. Investors from all over the world can invest and set up businesses in Hong Kong without worry or fear, and this will give added impetus to the development of Hong Kong.

Undersecretary for Financial Services and the Treasury of the HKSAR Joseph Chan Ho-lim agreed. He told the Global Times that Hong Kong has the unique geographical advantage of being "backed by the mainland and having influence across the Asia-Pacific."

According to Joseph Chan, the city's strategic position as a gateway to the Chinese mainland, coupled with its robust financial infrastructure, makes it an attractive choice for global investors and families looking to manage their wealth.

"The city's well-established financial services industry and strong inflows of funds have solidified its position as the world's second-largest wealth management center," he added.

Taking the remarkable growth of family offices and private trust businesses in Hong Kong as an example, as of the end of 2023, Hong Kong had about 2,700 single-family offices (with assets under management of $10 million or more), nearly twice as many as Singapore. More than half of these family offices had assets under management exceeding $50 million. These enterprises are a crucial component of private wealth management, Joseph Chan added.

Hong Kong's assets under management grew 2.1 percent to HK$31.19 trillion last year despite economic obstacles and challenges, representing growth of 30 percent in five years, Joseph Chan told the Global Times.

Bank deposits remained stable, rising 5.1 percent in 2023 year-on-year. During the first five months of 2024, the figure was up 3.2 percent.

Despite facing challenges in the financial market over the past two years, the wealth management sector in Hong Kong has proven to be strong and resilient, Joseph Chan said. The figures indicate that concerns about capital outflows from Hong Kong were unfounded, and they showed that the city is continuously optimizing the business environment.

Since Hong Kong's return to the motherland, while there have been ups and downs in the economy, the average GDP growth rate has been about 2.6 percent per annum, higher than the average growth rate of 2.0 percent for advanced economies.

In 2023, Hong Kong's per capita GDP was about $50,500, among the highest globally, according to data released by the HKSAR government.

A view of Hong Kong Photo: Zhang Weilan/GT

Boasting connectivity

Hong Kong plays a crucial role in attracting global investment and promoting financial innovation, and it serves as a key gateway connecting the domestic and international markets.

The city thrives on close financial integration with the Chinese mainland and extensive networks with the rest of the world, Darryl Chan said, adding that with more than 40 years of reform and opening-up, Hong Kong has successfully navigated a path to effectively leverage its unique advantages as an international and market-oriented financial hub to proactively connect the domestic and overseas markets.

Amid fierce competition among major international financial centers, Hong Kong has advantages, namely a high level of internationalization and the advantage of connecting the Chinese mainland with the world, which offer a good example of how Hong Kong and the Chinese mainland can achieve mutual success and create win-win results, Leung said.

The role of Hong Kong as a connecting platform in going global and attracting foreign investment for the Chinese mainland allows the city to be a "super connector" and a "super value-adder," Leung noted.

Hong Kong's appeal as a financial center is multifaceted. International investors can access a suite of connect programs covering stocks, bonds, exchange-traded funds and wealth management products that offer access to financial assets in the Chinese mainland, Leung told the Global Times.

Another notable example of Hong Kong's and the Chinese mainland's collaborative financial innovation is the internationalization of the yuan. According to the HKMA, as the world's biggest market for the offshore yuan, Hong Kong processes nearly 70 percent of settlements involving the currency worldwide.

The city had about 1.2 trillion yuan in offshore deposits as of April, up 22 percent year-on-year.

Noting Hong Kong's vital position in the internationalization of the yuan, Darryl Chan said that as China attempts to broaden the use of the yuan in international transactions, Hong Kong will likely have a bigger role to play in this process.

The financial regulatory authorities of Hong Kong and the mainland recently announced policy measures to promote and deepen cross-boundary financial connectivity and cooperation. One of the key focuses is the "Three Connections, Three Facilitations" initiative, jointly announced by the HKMA and the People's Bank of China earlier this year, comprising six policy measures to support the yuan's internationalization and facilitate business activity.

Hong Kong's commitment to integrating deeply into the Guangdong-Hong Kong-Macao Greater Bay Area has brought it closer to the mainland's economic development, promising an even brighter future, Chan said, adding that the city's pool of top-notch talent and capacity for financial innovation are recognized as key competitive advantages fostering greater economic momentum.

- Tags